Get on the Roth Bandwagon

I think everyone should consider changing from pre-tax 401k savings to Roth 401k savings if available; contribute to Roth IRAs if eligible, and convert pre-tax IRAs to Roth IRAs in amounts to max out the current 24% tax bracket.

Contributions to a Roth IRA are taxable and are not deductible but earnings grow tax-free in retirement. Converting from an IRA account to a Roth account is a taxable event. Once converted, the Roth earnings grow tax-free. The contribution limits apply to both the Roth IRA and Traditional IRA. Click here for IRS details on Roth's.

You might not realize the benefit for 10 or 20 years. So why the urgency? Because the strategies to implement take a decade or more to fully mature and the clock could be ticking on how much longer you have to make some of these changes. Similar to refinancing your mortgage to an incredibly low rate mortgage last year, you might look back 15 years from now and say – wow, that was awesome that we converted our IRA to Roth way back in 2021!

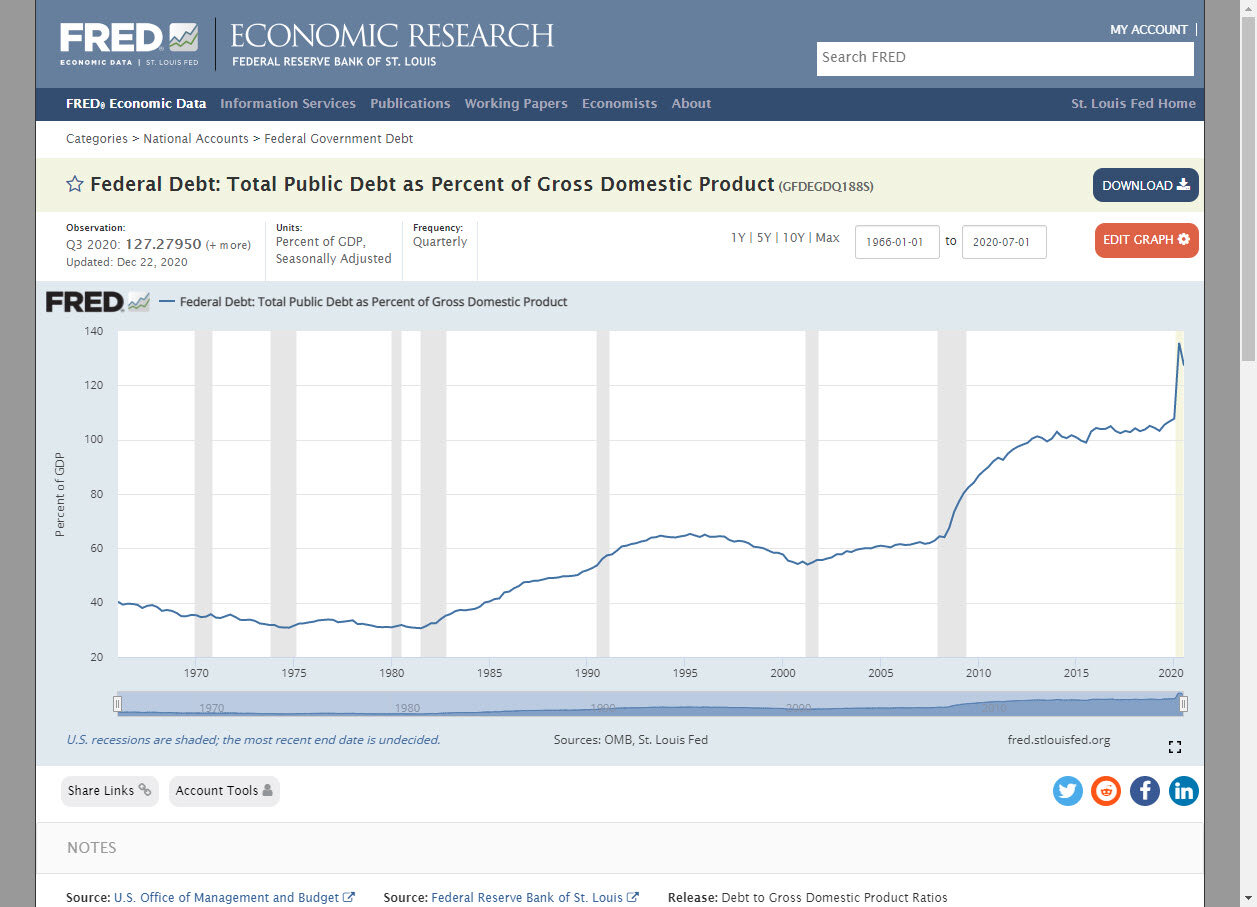

Here are the cliff notes. Current tax rates are some of the lowest they’ve been since before WWII and our federal debt to GDP (the economy) is the highest it’s been in our history. Future tax rates could be much higher, so now might be the opportune time to move money from a taxable position (retirement spending) to a tax-free position (Roth).

Read on if you want to know why I believe Roth contributions and conversions could be your planning opportunities of the decade.

I’ll be 49 years old in March 2021. I’ve been working for as long as I can remember. Typical childhood Upper Peninsula jobs - mowing lawns, chopping and stacking wood, and catching the neighborhood skunks. By age 12, (1984) I had my first “W2” job and officially became a taxpayer in the 12% bracket. By 1996 I was making decent money and was in the 31% federal tax bracket. That’s when I learned how the bracket system worked. I paid a portion of my income at 31%, but my actual tax was just 17% of my total taxable income. Click here if you don’t understand how the tax brackets work.Throughout my working career, I’ve only experienced historically low tax rates. In fact, even though my income grew throughout my career, my actual federal income tax has remained reasonable.

That might change dramatically in the years ahead. I encourage you to click on all the links available throughout this document.

I find it humorous when an article summarizes the exact reason the market is up or down for the day. Life and tax policy is not that simple. So I’m not targeting a singular event as to the reason taxes were much higher in the past than they are today. However, I will illustrate a few facts from the past and show current events to connect why we should all consider the possibility that taxes could be much higher in the future. And just in case they are higher, suggest you do some strategic planning today. You work hard to save your money to someday spend it – not to give it away in taxes.

We advanced over 100% federal debt to GDP by 2013 but flew way past that with the federal fiscal response to COVID. Our federal debt to GDP is around 130% (as of 2020). We currently have around $28 trillion in total federal debt. This doesn’t include the $1.9 trillion just signed by President Biden, a potential infrastructure package later this year, or the normal deficit. Our federal debt could be $32 trillion or more by the end of 2021.

The last time our federal debt was over 100% of GDP was when WWII ended in 1945 at 114%. The debt ratio grew to 118%, before slowly declining to the low 30s prior to Reagan’s tax cut in 1981. From that time on forward the ratio of total federal debt to GDP grew.

The federal government recovery response to the financial crisis of 2008 was expensive. By the end of 2008 we had around 10 trillion in total federal debt. By the end of Obama’s term it was around 19 trillion. Federal debt growth continued under Trump, and we had another 4 trillion of federal debt going into the pandemic year 2020.

What wasn’t happening under Trump was Federal Reserve intervention. The Federal Reserve was easing its balance sheet after years of accumulation. The Federal Reserve sets interest rates and the use of their balance sheet as primary tools to control/influence the direction of the economy. The Fed went from only modestly expanding their balance sheet to more than doubling it in just a couple months during the financial crisis of 2008. It was unprecedented and many speculated hyperinflation was just around the corner. To many economists surprise, inflation never came, and the Fed continued to expand their balance sheet (buy assets). By January of 2015, it peaked at around $4.5 trillion (from around $900 billion in September 2008). And then came the pandemic. Just like the federal debt explosion, so did the Federal Reserve balance sheet. It jumped from around $4 trillion in March to around $7.5 trillion in less than a year.

Like I said earlier, federal debt to GDP grew steadily after Reagan’s tax cuts, and then jumped into unchartered territory from the economic crisis of 2008 into the pandemic of 2020. Unlike 1945, this time around the Federal Reserve simultaneously expanded their balance sheet massively from around $900 billion in 2008 to $7.5 trillion today. A bold strategy never before tested and therefore we can only speculate to what might follow.

I’ll give you one more major tidbit of information to ponder.

The last time we reduced our federal debt from 118% of GDP was during an era of incredibly high tax rates. The 1980s were a long time ago and it’s easy to forget what taxes were like back in the 50s, 60s and 70s. So I’ll give you a little reminder.

Would you believe it if I told you that the highest tax bracket throughout the 1950s and into the 1960s was 91%? Or that the lowest tax bracket during that same era was 20%? Yes, the lowest tax bracket was more than the average tax that people pay today. A single person making $26,000 in 1955 was in the 62% tax bracket.

One of the reasons I believe our federal debt is so high is because it’s so easy to pay for it. The current average interest rate of our federal debt is 1.695%. Back in 2006 it was 5.034%. Even though the debt has gone up by around $20 trillion since then, our payment only went up around $117 billion ($522 billion payment in 2020). You can do the simple math, if average interest rates were 5% on our debt, the payment would be about a trillion more than we pay today.

If there’s one thing I’ve learned in this business it’s that eventually things become normal again. It’s not normal for the federal debt to be 130+% of our economy. It’s not normal for the Federal Reserve balance sheet to grow 733% in 12 years. It’s not normal to have federal debt interest be under 2%. Numbers have a way of coming back to normal. Sometimes it takes a long time, and sometimes it costs a lot of money. But eventually it tends to happen. The two primary drivers in this equation are economic growth and tax rates. The amount of economic growth to solve the equation alone would be phenomenal, of the like we haven’t seen in our history. But we could once again see the tax rates of my parents and grandparents days.

So what does this mean? Back to the beginning paragraph of this article, “I think everyone should consider changing from saving pre-tax 401k savings to Roth 401k savings if available; contribute to Roth IRAs if eligible; and convert pre-tax IRAs to Roth IRAs in amounts to max out the current 24% tax bracket (which for married couples is $329,849 and $164,924 for single taxpayers).”

It’s easy to assume things will remain reasonable throughout life. Previous assumptions were that personal income would be lower in retirement and therefore their tax bill also be lower. That assumption could be horribly wrong and dreadful when people spend their money. The carrot of pre-tax savings into a retirement plan isn’t looking so attractive to me right now. Why save pre-tax when we are in the lowest tax rates since basically the 1930s, and the government balance sheet looks worse than it ever has in history?

Maybe tax rates don’t go up really high a decade or more from now. We could experience economic growth like we never imagined and growth solves the equation. But I don’t want to count on that as the only solution to this massive problem. Pre-tax savings has helped millions of Americans boost their retirement plan accounts. Now I think it’s time to balance things out for an unpredictable future. Even if tax rates remain the same decades from now, I believe everyone would like to have a portion of their income in a tax free position - https://www.irs.gov/retirement-plans/roth-iras.

I’ve been a huge fan of Roth’s for years. The current status of our government balance sheet has taken my interest in Roth’s to a completely new level. We’ve been working through these scenarios with our financial planning clients throughout 2021. If we haven’t talked yet, please call us right away so we can help you make these important decisions. And if you have kids or younger people in your life getting started in their 401k, please encourage them to check the Roth box if offered and not the pre-tax box on their contribution form. I think they will thank you later!

Thanks!

James Studinger-