What to do Before the S&P hits 5,000

Someday the S&P 500 will hit 5,000. A number I’m using to identify recovery and signal potential changes in investment strategy. Here’s what 5,000 means to you.

If you are still saving and are pre-retired - Buy as many shares of the market as possible.

401k and investment statements are positioned to represent how much money we have at any given point in time. But they also inform us about how much of an investment we own. We tend to celebrate portfolio values rather than the metric that drives future value – how many market shares we own.

For example, I recently met with a client and reviewed her 401k. She had been putting money into her investments and saw the value drop below her deposits. She asked if she should stop buying into the market until it has recovered. While witnessing a value decline is depressing, it also allows us to buy more shares at lower prices. For illustrative purposes, in December of 2021, she had 35 shares of a S&P 500 index fund within her 401k portfolio. That fund was worth about $20,000. That means it traded for $571/share. She now has 69 shares of the investment, and it’s trading at about 400/share and has a value of about $27,600. She has $7,600 more than before, but she contributed more than that amount. Someday the S&P 500 will recover, reaching $571/share and beyond. If that were to happen tomorrow, her fund value would be $39,399 (69 shares x $571), almost twice her value from December 2021 and significantly more than she contributed.

The market won’t recover in a day or a month, and it might not even fully recover for a year. But that isn’t bad news for her. The longer it takes to recover, the more money she’ll make. Instead of focusing on the dollar value of her investment, I asked her to focus on the number of shares she owns. She increased her share count from 35 to 69, almost double what she had before. The longer it takes for the market to recover, the more time she has to buy shares at depressed prices. Maybe she’ll acquire another 15, 20, or more shares before the S&P hits 5,000.

If you believe, as I do, that one day the S&P 500 will hit 5,000 then you also understand the math where the more shares of the market you own, the richer you will become in the future.

Convert your 401k or IRA to a Roth before the market recovers.

Like buying shares at depressed prices, converting to a Roth during a down market can increase the overall amount of money you have to spend in the future. Converting shares that are cheap allows you to put more money in a tax-free Roth account and pay less in tax dollars during the conversion.

The cost of tax-free money in the future is the taxes you pay to put the money into the Roth in the first place. There are two potential advantages to converting in 2023. First the more predictable advantage: the stock market will be more valuable in the future than it is today. The second advantage seems likely but still needs to be determined: taxes are likely to be higher in the future than they are today. We have the lowest tax rates since the Great Depression and the worst fiscal balance sheet in the history of our country. That simple reality is logical enough for me to assume that we’ll all be paying higher tax rates later in life. But regardless if that becomes true, the first advantage of converting before the market fully recovers is that the market will someday fully recover. And I’d rather get that potential growth in a tax-free Roth IRA account than pay taxes on withdrawals when the portfolio is much larger.

If you are retired or near retirement - Don’t sell your equity shares at losses for tangible purchases.

You could sell an equity investment to buy a better one. But don’t sell your stocks at a loss to buy groceries, take vacations, pay bills, or other non-wealth-producing expenses. That means you need other alternatives, like cash, bonds, and other fixed assets; or that your retirement income supports your living expenses.

If you have expenses on the fringe of necessity, try to defer your spending for the future when the market has recovered. If you have expenses that equity sales must cover, then look at the portfolio and determine which of your equities makes the most sense to liquidate. Some positions held up better during the downturn or might not be poised to recover as well in the future.

In either case. . . Know what you own and adjust if necessary.

Sometimes people keep bad investments just because they are down, or they don’t know with what else to replace them. Avoid managing money that way. We are imperfect emotional human beings. And we have extremely limited helpful information to determine the direction of the future. But there is logic to investing. Own what’s in your portfolio for purposeful reasons and make changes when necessary.

Keep learning.

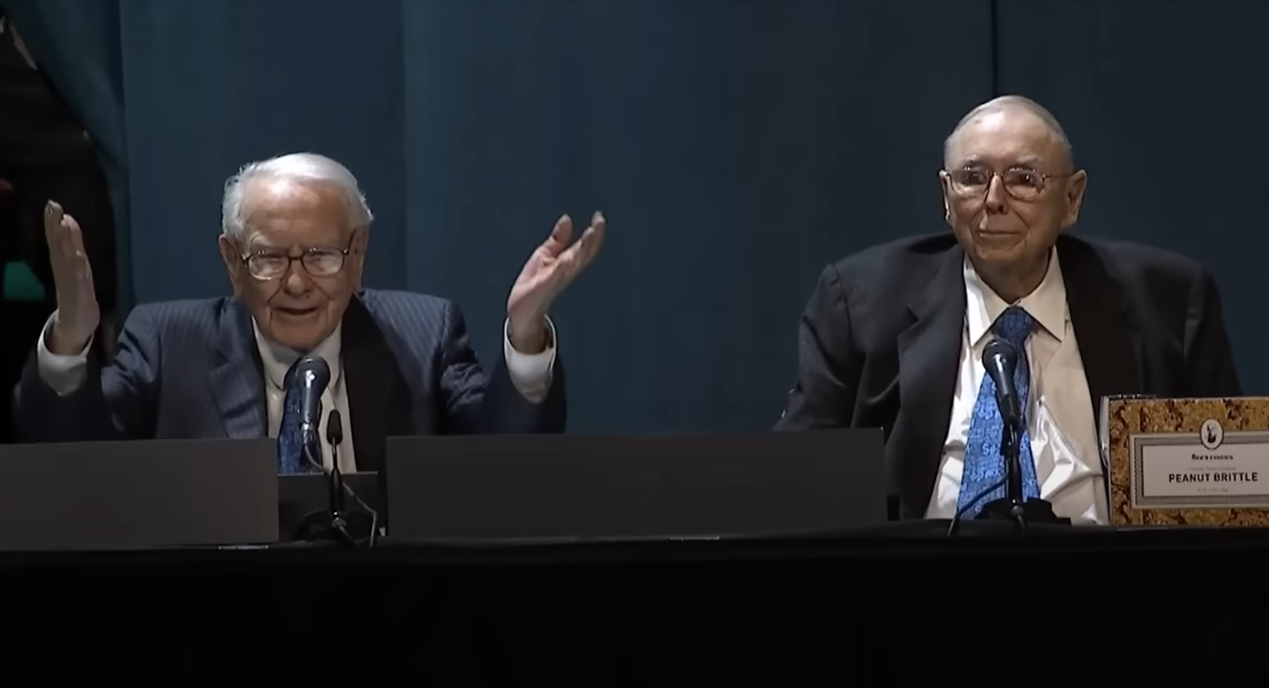

Berkshire Hathaway recently had their annual shareholder meeting where Warren Buffet and Charlie Munger answered audience questions for about 3 hours. It’s a long listen, but if you want to hear some advice from a couple of sharp guys in their 90s – there are some great gems of advice from relationships, estate planning, fiscal policy, the banking industry, energy, and of course – investing.

As always, call us or email with any questions or ideas. js@jpstudinger.com 248-643-6550.

James Studinger

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS. JP Studinger Group, LLC is not affiliated with Kestra IS or Kestra AS. Investor Disclosures: https://www.kestrafinancial.com/disclosures

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security.